New SAP Asset Accounting Overview

by Dinesh Kumar

SAP S/4HANA Finance (formerly SAP Simple Finance) comes with a lot of features, such as the universal journal, streamlined design, and real-time analytics. The new SAP Asset Accounting (FI-AA) module has been redesigned in the S/4HANA suite to increase process efficiencies across the life cycle of an asset.

Additional advantages of migrating to new Fixed Assets features in SAP HANA are listed below.

New SAP Asset Accounting Features

- Due to the streamlined model, depreciation postings and runs finish a lot faster, improving financial close and the overall management accounting business process.

- Data redundancy has been reduced, and you have to use fewer FI-AA tables. Actuals line items are stored in the universal journal (ACDOCA) by company code and fiscal year instead of in a variety of tables (including ANEP, ANEK, ANLC, ANLP, and ANEA). Plan and statistical data are stored in individual tables.

- You can choose between the accounts and the ledger approach for asset postings. In the accounts approach, different valuations on different accounts are reflected in the same ledger. In comparison, if you use the ledger approach, different valuations or different accounting principles are reflected in relevant separate ledgers.

- The two approaches have many similarities, such as separate documents are created for each accounting principle or valuation. For each valuation, there is only one depreciation area that posts to the G/L in real-time, and valuation is based on one or more depreciation areas.

- Since the posting of actual values of the leading valuation and values of the parallel valuation occur in real-time, delta depreciation areas are no longer needed.

- In classic FI-AA, it was necessary to restrict postings related to valuations by mapping appropriate transaction types to depreciation areas. This is no longer required in the new FI-AA. Why? Because you can now specify in a transaction to which depreciation area or accounting principle (ledger or accounts) you are posting.

- This means that you do not need to go through the hassle of maintaining transaction types as an intermediate step. Since the concept of transaction types for depreciation areas is made redundant, the maintenance overhead for these transaction types is eliminated. Note that transaction types in standard or traditional FI-AA identify the type of asset transaction such as depreciation or down payments.

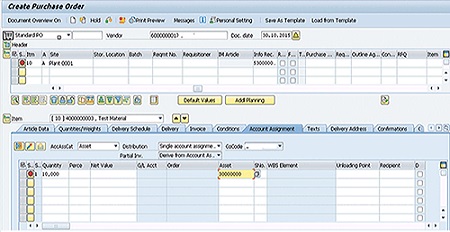

- Due to the improved design and tighter integration among the various FI components, you are now able to post to FI-AA directly from other modules (i.e. such as a production order or a goods receipt or an invoice directly to an asset). Consider this example. In Figure 1, I am in the process of posting a purchase order (PO) to an asset.

An SAP purchase order assigned to an asset.

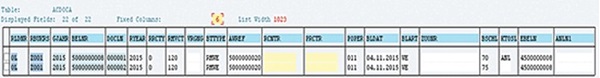

After I post this document, I create a goods receipt with reference to this PO. The goods receipt document generates two accounting documents in table ACDOCA (Figure 2). As you might know, the value of RMWE in the BTTYPE field is the activity indicator for the original goods receipt.

Goods receipt postings in table ACDOCA

Preparing for Migrating to New Asset Accounting

To use the new FI-AA module, you must have the SAP General Ledger activated in the Financial Accounting module and running in your SAP system. Other than the activation, no configuration steps are necessary because all the SAP General Ledger scenarios are active by default. The only exceptions are document splitting or adding a ledger.

Also, you do not need to make any changes to your master data. Master data from your classic FI-AA is leveraged per se by the new FI-AA.

I mention this as there is a perception in the industry that you can jump from the classic General Ledger directly to SAP S/4HANA Finance. I have also encountered the perception that migration involves making changes to your asset master data or that the master data is affected in some way. These are incorrect perceptions.

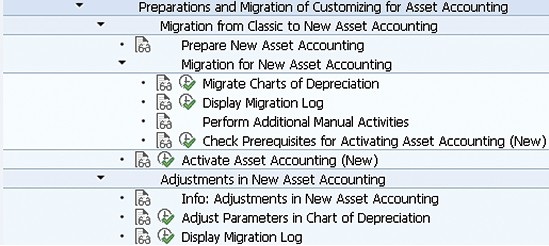

Figure 3 displays the list of activities you need to carry out to prepare for and migrate to new FI-AA. The activities at a high-level are:

- Preparation activities

- Migration activities including charts of depreciation migration, execution of additional manual activities as applicable, and checking prerequisites for activating the new FI-AA

- Activating the new FI-AA

- Adjustments activities

Activities in the IMG for migrating to the new FI-AA.

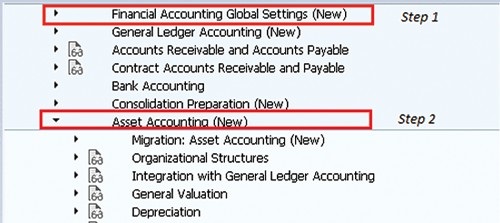

Before you start your preparation for migration, you first need to check the global settings (step 1), make the appropriate changes. If needed, such as the creation of the necessary ledgers and ledger groups, and then carry out the preparation and migration activities (step 2). This is shown in Figure 4.

Sequencing your FI-AA migration activities

If you are migrating from classic FI-AA to the new FI-AA, you need to execute the migration activities that are relevant to your enterprise. I recommend that you read the documentation in the “Prepare for New Asset Accounting” step in the IMG as shown in Figure 4. The document lists all steps needed to be carried out before starting your migration into the new FI-AA.

I also recommend that you carefully read the documentation for “Perform Additional Manual Activities.” Depending on your particular situation, some of these manual activities could be relevant to your enterprise.

What happens after you migrate? Your FI-AA transaction data is moved to the universal journal ledger (ACDOCA) from the existing FI-AA tables. As you start posting into the new FI-AA, documents post directly to ACDOCA, and no postings are made to specific existing FI-AA tables (as mentioned earlier).

You can identify these documents by checking for the posting key (technical field name BSCHL). Debit postings to an asset account have a value of 70, and a credit posting has a value of 75. Figure 5 displays a few relevant asset documents from table ACDOCA.

Asset postings in table ACDOCA

Note

There is a useful feature in the IMG activity menu called Overview for Experts. You can see this in Figure 4. If you are an experienced FI-AA configuration person, you will find it convenient to navigate to this node and check important FI-AA configuration activities such as depreciation areas, asset classes, and account assignments.

These activities are already available under relevant individual nodes elsewhere. Still, for the configuration experts, this is the place to go to for ensuring whether these key activities have been carried out. If not, you can execute directly from this activity.

by Dinesh Kumar

More Blogs by Dinesh Kumar

Account Based COPA - S/4 HANA Finance

As a reporting tool, profitability analysis (CO-PA) is very effective ...

SAP Simple Finance: The Future of Finance

With all the hype around Simple Finance, many companies are curious ab...

Related Blogs

Eating your own dog food: How we use our own SAP...

I like companies that ‘eat their own dog food’…in o...

Exceptional EPM/CPM Systems are an Exception

Quite naturally, many organizations over-rate the quality of their ent...

SAP Indirect Access - Is it a Bad Business Move?

By now most of you have heard of the SAP indirect access case. And you know the...

.png)